Foreign Trade: An Overview

Editor’s note: This is a follow up post on foreign trade for US companies buying overseas.

From the US point of view, we export when selling and we import when buying. The term “balance of trade” or net exports, is the difference between the monetary value of exports and imports over a period of time. A positive balance of trade is a trade surplus and results from greater exports than imports; a negative balance of trade is a trade deficit or a trade gap and results from greater imports than exports. For example, the US had a trade deficit with China in 2006 as we imported (bought) from China about five times as much as we exported (sold) to them.

According to the US Census Bureau Foreign Trade Statistics, the top ten US trading partner countries account for 66% of US imports, and 62% of US exports. This means that all the other 240 or so countries in the world combined account for about the other third of all US foreign trade!

Canada

Canada has consistently been the US’s largest trading partner and perennial leader in total trade, exports and imports. Canada exports agricultural, fish and food goods, petroleum, forestry products, machinery & equipment, industrial goods, metals, chemicals, and consumer products.

Trade with Canada is easy for most American companies as the two countries share culture and language to a great extent. We can expect the balance of trade to trend toward the US over the near term as the recent rise of the Canadian loonie and fall of the US dollar make US goods cheaper to buy in Canada and Canadian goods more expensive in the US.

Mexico

Mexico is a unique trading partner because of the North American Free Trade Agreement or NAFTA has dramatically altered the export/import landscape. While oil continues to be a major export from Mexico, the many US countries manufacturing “in bond” is a relationship shared by no other US trading partner. In one curious twist, the largest port “in Mexico” is Houston. Houston receives more raw materials headed to the Maquiladora strip of US manufacturing plants along the Rio Grande than any Mexican port. Finished goods are then returned to the states for internal consumption or export.

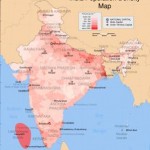

INDIA

India

India enjoys a thriving and growing economy and presents an interesting case. Although the US imports engineering goods, petroleum products, precious stones, cotton apparel and fabrics, gems and jewelry, handicrafts, tea, among many other commodities from India, it accounts for less than 1% of US foreign trade, ranking below the small country of Ireland.

WESTERN EUROPE

western Europe

Currency differences similarly affect trade with our European partners whose Euro monetary unit has risen sharply against the US dollar making their goods more expensive to the US buyer/importer and thus affecting the balance of trade. Although we do not share as great a cultural and language overlap with our western European partners as enjoy with the Canadians, our long tradition of business provides well traveled path.

France, the ninth-largest trading partner of the US, exports aircraft and engines, beverages, electrical equipment, chemicals, cosmetics, and luxury products. Germany’s main exports to the USA include motor vehicles, machinery, chemicals, and heavy electrical equipment.

The United Kingdom and the US experienced a near even trade relationship in 2006. Principal exports from the UK are machinery & transport equipment, manufactured items, chemical products, mineral fuels and lubricants, beverages and tobacco.

ASIA

Asia

These countries tend to be the most difficult for Americans for many reasons: language, culture, religion, food, and traditions are so different that it takes time, practice, and education to master them. For instance, a direct question posed to a Chinese supplier may result in a nod and a yes answer. However, that quite probably means that he understood the question rather than expressed agreement.

In descending order, our largest Asian trading partners in 2006 were China, Japan, South Korea, Taiwan, and Singapore. Because of their vast population and awakening economies, these countries are likely to be the greatest growth markets for US imports and exports over the near term.

While the robust economies of Japan and South Korea are more familiar territory for US importers, is wise to proceed more slowly with the lesser developed nations. Ample evidence of trade problems with Chinese suppliers include poor quality, contamination, lack of continuity in supply chain processes and the like gives pause to the cautious buyer.

As advances in technology, transportation, and awareness shrinks the global commerce onion, it expands the commercial opportunities. Potential American importers would do well to learn as much as they can about global economy, study the language, culture, and export ability and capacity of likely trading partners, and to visit these countries and suppliers before invest the first purchasing dollar.