Robert Menard

Certified Purchasing Professional,

Certified Professional Purchasing Consultant, Certified Green Purchasing Professional, Certified Professional Purchasing Manager

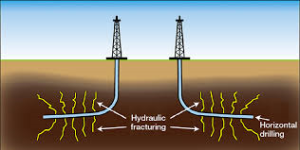

Should we be recycling fracking water? OF COURSE WE SHOULD. Even the cost argument pales in face of the severe drought affecting most of southwestern United States and the hundreds of millions of thirsty farm acres and millions of residents. Most folks connected with the practice of hydraulic fracturing or fracking, whether pro or con, understand that it takes about a gallon of water for each gallon of oil that is produced. Natural gas requires less water but horizontal drilling (directional) requires more water than vertical wells.

With all the hubbub surrounding hydraulic fracturing and its so-called “environmental impact”, it may be surprising to learn that this practice is almost 70 years old. What is relatively new to the Oil & Gas technological scene is the emergence of directional drilling. These two processes, in tandem with enormous tax benefits (which we will discuss in a later post) are driving oil and gas production to blow out of the ground, quite literally.

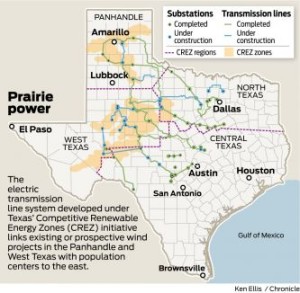

Accompanying the frenetic pace of production is an enormous strain on water resources. Many parts of the US which are blessed with petroleum reserves, such as Texas, are also suffering under withering years long droughts. Lake levels are falling, water restrictions are common, yet surface lakes and underground aquifers are being tapped for billions of gallons of fresh water for hydraulic fracking. People and farms need the same water for survival.

The problem is obvious and so is the solution

Until recently, the popular method of disposing of the contaminated fracking waster was to pump it into wells thousands of feet below ground level. Pressure in terms of Corporate Social Responsibility (CSC) is encouraging some drillers and operators to embrace recycling. The Wall St Journal reported in a late 2012 story that industry giants like Halliburton and Schlumberger favor the practice. Smaller companies like Ecologix Environmental Services LLC and WTC, Inc. are jumping into the recycling pool. Ecologix claims that the cost of recycled fracking water is less than disposal costs.

Other big names like Chesapeake Energy Corp is recycling 100% of its fracking water from wells in northern PA. This is cutting costs and reducing the number of trucks hauling water to drilling sites, an irritant for neighbors around well sites.

Other big names like Chesapeake Energy Corp is recycling 100% of its fracking water from wells in northern PA. This is cutting costs and reducing the number of trucks hauling water to drilling sites, an irritant for neighbors around well sites.

Recycled fracking water cannot be used for human consumption or irrigation but it can be used again for fracking. In some locales, wastewater effluent is finding its way into fracking. Pioneer Natural Resources operations in the Eagle Ford and Permian are using waste water from the city of Odessa and negotiating with the city of Midland for its wastewater. Halliburton claims that it has developed a fluid that eliminates the need to pretreat waste water for fracking.

For the near term, the costs of recycling fracking water will remain confined to larger companies who can afford the technology and need the CSR profile. Smaller operators might be able to afford the equipment but not the rights of way and pipelines to hook facilities together.

Just do it

The old athletic wear ad is right. The necessity in using recycled water for fracking will soon be here, whether imposed by law, CSR, or economics. It is just the smart thing to do. As in the so-called “green energy” world of electric power, can green energy fracking funds be far behind?