Robert Menard

Certified Purchasing Professional,

Certified Professional Purchasing Consultant, Certified Green Purchasing Professional, Certified Professional Purchasing Manager

North Americans and Europeans are so inured to reliability of electricity energy supply that only a small fraction of us worry about it. As the world increasingly explores alternative forms of electricity generation such as wind and solar, the crucial issue of “energy storage” rises to the top of problems to be solved.

First, let’s clarify the mystery enshrouding electricity. We cannot see it, but accept it in our lives, the same way we do piped water systems. Since the days of Thomas Edison, electricity has been generated the instant it is demanded. Until recently, the electrical energy could not be easily, efficiently, or cheaply stored.

To simplify electricity, resort to Ohm’s Law, the basis for engineers and physicists.

Ohm’s Law E = IR, where

- · E is voltage

- · I is current

- · R is resistance of a system

An interesting development proceeds from Ohm’s Law that will help you understand the tangible relationship amongst voltage, amperage, and resistance. In a simplified system, power is equal to voltage multiplied by amperage. The product (answer to the multiplication) is expressed as wattage or Watts.

Applying Ohm’s law, a 120 W light bulb attached to a 120 volt (house) circuit draws 1 Amp.

- E x I = Watts

- Substituting E @ 120 V and Watts at 120W,

- Solving for I = 120/120 = 1 Amp

How to visualize the concept of electric energy

To visualize electricity, compare it to the more familiar water system.

- Voltage (Electromotive force or EMF) is equivalent to the pressure driving water and is measured by Volts

- Amperage (current or electron flow) is equivalent to the flow of the water and is measured by Amperes or Amps

- Resistance Conductor size and material (copper, aluminum, etc.) resist electron flow just as pipe size and material (concrete, metal, plastic, etc.) does in a water system. It is measured in Ohms.

What does it mean to store electricity and how is it done?

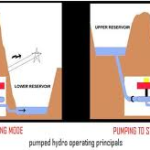

Storing electrical energy in batteries is an old and familiar technology. Four other technologies are also not new but gaining in popularity as an energy hungry world seeks new ways to feed the power demand. The oldest and most efficient is Pumped Hydro. In the 1890’s, the early days of utility scale power generation, hydro generation became popular, particularly in western North America. During periods of high demand and cost, usually day time hours, hydro power is generated by conducting water from high levels, through turbines, and then discharged at the low end. The quantity of energy created is a function of volume of water (called discharge or the flow volume per unit time) and the difference in high and low elevations, known as hydraulic head. During periods of low demand and cost, usually night time hours, water is pumped to higher elevation reservoirs and the process is repeated the next day. The cost differential between the high and low demand times is called arbitrage.

Each of the various means of electric energy storage has pros and cons. Excepting Pumped Hydro, they are expensive and limited in application but enterprising companies are hard at work making these means less expensive and more efficient. Let’s describe the five most popular storage technologies.

Each of the various means of electric energy storage has pros and cons. Excepting Pumped Hydro, they are expensive and limited in application but enterprising companies are hard at work making these means less expensive and more efficient. Let’s describe the five most popular storage technologies.

Energy is sored in the potential form of hydraulic head, essentially a difference in elevation. It enjoys low costs, long life, high efficiency, and is a mature technology. On the down side, it needs some specialized sites, and suffers from low energy density and low power density.

Compressed Air Energy Storage (CAES)

Compressed Air Energy Storage (CAES)

Energy is stored in compressed air in underground caverns or above ground tanks, and combined with LNG in turbines. It enjoys the same pros as Pumped Hydro but often needs special siting, especially caverns, and suffers from low energy and power density.

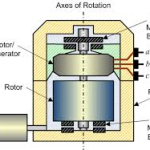

Flywheels

Electric energy is converted to kinetic energy in the form of a rotating mass. This mature technology can be low cost, has long life, and good efficiency, but also suffers from low energy and power density, and is difficult to scale to utility size.

Batteries

Batteries

Energy is stored in reversible chemical processes in electrochemical cells. Anyone with a flashlight is familiar with the concept of stored chemical energy being converted to electrical energy when a change in switch position produces a beam of light. This mature technology enjoys the benefits of potentially low cost, long life, and good efficiency. However, batteries are also low energy and power density, difficult to scale to utility size, and suffer some public relations problems over well publicized failures of Lithium Ion batteries with respect to spontaneous fires and sustainability.

Capacitors

Capacitors

Capacitors store electrons, they do not produce them as do batteries. They are potentially low cost, enjoy long life, and good efficiency. On the down side, they suffer from low energy and power density, and are difficult to scale to utility size.

According to the U.S. Department of Energy, Pumped Hydro owns 95% of the energy storage market with 23,400 MW. The other five technologies share the remaining 5% or 1,200 MW. The breakdown is

- Thermal storage 36% or 431 MW

- CAES 35% or 423 MW

- Batteries 26% or 304 MW

- Flywheels 3% and 40 MW

More on batteries

In September, Tesla Motors announced that it had chosen Nevada as the winner of a five state competition as the site of its $4 billion dollar 10 million square feet battery plant near Reno. That would equate to a huge oversupply of automobile batteries for the foreseeable future if most of the plant’s capacity was not consumed by much larger storage batteries.

Market research firm IHS predicts that the 2013 energy storage of 340 MW will grow to 6,000 MW by 2017, a stunning 1,746% in four years, and 40,000 MW by 2022, another astounding increase. Tesla plans to produce about 50,000 MW hours of battery storage annually by 2020. Lux Research LLC agrees with Tesla’s claim of a 30% price reduction, from the current $274/kWh to $196/kWh with most of the price reduction in the early years due to overproduction.

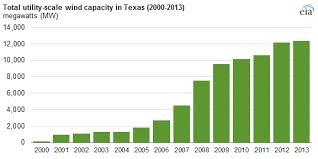

Increasing the Reliability of wind and solar

Both wind and solar powered electricity generation are inherently unreliable. Wind can be intermittent and in changeable vectors (quantities), solar is affected by shorter winter and cloudy days. Hydro power is more dependable, but also affected by seasonal and climatological changes. In the United Sates, reliability is a function of supply, demand, and frequency of alternating current at 60 Hz. Electricity storage technologies are emerging as a solution. Of the five technologies cited in Part 1 (link), batteries storage shows the greatest promise and is the fastest growing.

Capturing and storing energy created by the natural forces of wind and sunshine is crucial to taking these alternatives to utility scale production. Rechargeable Lithium-Ion batteries is the favored technology of cutting edge companies like Tesla. However, it is not an ideal solution. Besides its energy and lower density problems, it is also a short term solution, usually less than two hours.