Harry Hough, PhD, founder of the American Purchasing Society

Editors note: Dr. Hough is a regular guest contributor to this blog.

Different methods apply when negotiating and purchasing services. Typical services used by most businesses include repair or maintenance of equipment, cleaning, and landscaping. Professional services such as accounting, legal , and engineering require unique treatment. Design and advertising services are other areas needing attention.

Purchases for tangible products are covered in the law by the Uniform Commercial Code whereas in most areas the purchases for services fall under the guidelines of the common law. The UCC does much to protect the rights of the buyer and facilitates transactions. Absent protections offered by the UCC, the buyer must be careful to negotiate an agreement that protects issues accurate and complete documentation that records the purchase.

Selection of a Qualified Supplier

It is easier to pick a supplier with a tangible product. It is more difficult to evaluate a service. Therefore it is more important to obtain creditable references and check them out thoroughly. A minimum of three references may be sufficient for other types of suppliers, but it may not when you want to select a new supplier for a service. The number of references and thoroughness of the checking should depend on the dollar amount of the expenditure and the importance of the service. Investigating a half dozen valid references isnot unreasonable. Make sure the customers are not related to the supplier. Evaluate the type of customer given as a reference. For example, is the customer a major company or a tiny business with few facilities or employees? Not always, but usually, larger organizations tend to do a better purchasing job. Although the reference from a larger organization is a favorable sign, it also might indicate that the service supplier may be more expensive or more difficult.

Prepare a list of questions to ask the customer reference

Prepare a list of questions to ask the customer reference

Do nt ask simple yes or noquestions. Get the reference to elaborate on answers. For example, instead of asking if he or she is satisfied with the service, ask what is liked most about the service or what is liked least. This will give you much more information and you can use the information when calling the next reference to either indicate a similar performance or to indicate that it might be an isolated instance.

Negotiating the Agreement

Negotiating the Agreement

Use any information you gained from the references to question performance. One reference may have indicated that the supplier did not always arrive on the scheduled day. This gives you the opportunity to question the supplier about schedules and regularity. However, it is not prudent to indicate which reference said what.

Ask the supplier to break down costs. Learn how charges are made. Is it an hourly rate? How much? What are total estimated hours required to do the job? Ask for a firm total cost. If the supplier indicates that it is impossible to say because each job is different, ask if a minimum can be given as well as an estimate of the actual cost. Ask for a detailed description of any required material needed along with separate prices for the material. Such items include, but are not limited to, repair parts, paint, and landscaping material used for the service. Ask that no markup be charged for material. Alternatively, the buyer may want to make any necessary purchases. In either case the reasonableness of the prices for material can be checked or controlled.

Protect the Company’s Interest

Make sure that any service supplier has workmen’s compensation insurance and liability insurance in force and in a sufficient amount. Obtain a copy of the insurance policies before allowing any work to be done on the premises. Get the supplier to sign an agreement not to disclose any information about the company to a third party. Make sure the supplier is aware of, and abides by local, state, and federal laws.

uality, Service, Delivery, and Price (QSDP)

uality, Service, Delivery, and Price (QSDP)

A table-tennis table manufacturer made tables for the specific purpose of out door recreation such as scout camps, vacation resorts, and cruise ships. To address the aggressive climatic influences of freeze-thaw cycles, marine exposure, and ultra violet radiation, the manufacturer contracted with a well known coatings supplier to design and apply an appropriate coating system to its tables.

A table-tennis table manufacturer made tables for the specific purpose of out door recreation such as scout camps, vacation resorts, and cruise ships. To address the aggressive climatic influences of freeze-thaw cycles, marine exposure, and ultra violet radiation, the manufacturer contracted with a well known coatings supplier to design and apply an appropriate coating system to its tables.

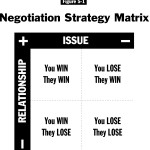

There are four strategies, Win-Win, Win-Lose, Lose-Win, and Lose-Lose. All are appropriate depending upon the importance of the Issue and the Relationship.

There are four strategies, Win-Win, Win-Lose, Lose-Win, and Lose-Lose. All are appropriate depending upon the importance of the Issue and the Relationship.

Suppose instead of doing nothing, you object to the salesperson. You tell him you are very unhappy with the payment term on the invoice that does not match your contract or the term specified on your purchase order. He tells you not to worry, it doesn’t mean a thing. He says that is only a standard term for others. Don’t believe him. Maybe the supplier won’t refuse your business, but your credit rating could still reflect a bad report.

Suppose instead of doing nothing, you object to the salesperson. You tell him you are very unhappy with the payment term on the invoice that does not match your contract or the term specified on your purchase order. He tells you not to worry, it doesn’t mean a thing. He says that is only a standard term for others. Don’t believe him. Maybe the supplier won’t refuse your business, but your credit rating could still reflect a bad report.