Robert Menard, Certified Purchasing Professional, Certified Professional Purchasing Consultant

Boeing’s decision to move the production capacity of the 787 Dreamliner family of aircraft from Washington state to South Carolina exemplifies the power of negotiation strategy. The action stems in part from high labor costs at Boeing’s Renton and Everett WA plants and crippling strikes that have caused customers to cancel orders or defect to their Airbus competitor. A ‘Dollars and Numbers’ justification for Boeing’s decision is presented below but let’s first examine the negotiation strategy that drove the decision.

Negotiation Strategies

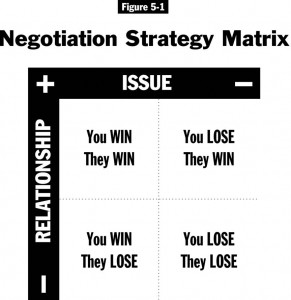

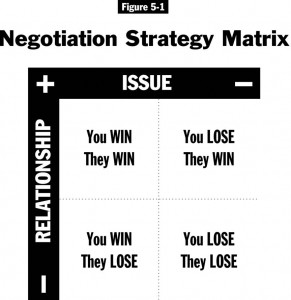

The four strategies of Negotiation are Win-Win, Win-Lose, Lose-Win, and Lose-Lose. The selection of appropriate strategy is determined by a four quadrant matrix that evaluates Issue and Relationship.

Boeing and the International Association of Machinists and Aerospace Workers (union) have been engaged in a long term partnership. The highly valued Issue of competitiveness and the long term Relationship with its high quality unionized work force were crucial to Boeing making Win-Win the overwhelmingly preferred negotiation strategy over many years.

Issue and Relationship

Over the past 25 years, the globalization of the economy and surge in low cost manufacturing particularly in Asia, has thrust the Issue of competitiveness to the fore. Add the truculence of the union foisting four damaging strikes in 20 years, including one in 2008 for 57 days that cost Boeing $2 Billion, and it is clear that the negotiation strategy appropriately migrated to Win-Lose as the Issue grew more important than the Relationship.

Negotiation Strategy Matrix

According to news reports filed by the Wall Street Journal, Bloomberg News, and Business Week, the 2008 strike motivated Boeing to seek an 8 year no-strike contract in recent negotiations with the union. In return for the no-strike labor harmony, the union sought such to extract costly demands for which agreement by Boeing would put it in severe jeopardy of losing many orders and customers. This would not only have hurt Boeing and its shareholders, but the union would have ultimately been the big loser as lost sales translates to lost jobs.

On Nov 06, 2009, Business Week quoted Boeing CEO W. James McNerney who said that “about 3,800 jobs in South Carolina will loosen the unions’ choke hold on the company”

The Wall Street Journal quoted Jim Albaugh, CEO of Boeing’s Commercial Airplanes Unit, commenting on the move to SC, “It improves our competitiveness.” He added, “Coming here will help us to sell more airplanes.” Clearly, competitiveness was the Issue for Boeing. With the competitiveness Issue, perhaps even Boeing’s long term viability dominating the bruised and teetering Relationship with the union, Win-Lose was the appropriate strategy.

Dollars and Numbers

Good business decisions are decided by analyzing dollars and numbers. Expressing a challenge’s dimensions in objective and measurable quantities of dollars and numbers produces far better results than emotional gambles or seat of the pants guesses. Negotiation decisions such as Boeing’s is another opportunity to apply the thoughtful Total Cost of Ownership (TCO) analysis that is the hallmark of a business pro.

According to Boeing’s web site, orders for 840 airplanes valued at $140 billion have made this 787 Dreamliner the most successful launch of a new commercial airplane in Boeing’s history.

Further, the 787 Dreamliners prices range from $150 Million for the low end 787-3 class to $205.5 Million for the high end 787-9 class. Business Week states that the average hourly labor costs in WA are $26 versus $15 in the right to work strongly non-union SC or more than 40% less. To analyze this Issue from a dollars and numbers perspective, assume a hypothetical example of a mid range plane with a price of $208 Million.

Assuming for calculation’s sake that half of the price represents labor cost, an aircraft which sells for $208 Million has $104 Million in labor cost built into the price. To obtain the number of labor hours, divide the $104 Million by $26/hr yielding 4 Million hours at the WA plants. At the SC plant, the 4 Million hours at $15/hr total only $60 Million, a whopping $44 Million difference per plane! Multiply this by 840 planes and the total savings approach $37 Billion.

online training in purchasing, negotiation, and sales

Not so Fast on Pulling the Savings Trigger

These hypothetical savings will be eroded by costs of relocation, construction, and plant & equipment expenses costs. Boeing is required to invest $750 million and create 3,800 full time jobs over a 7 year period. However, these costs are mitigated by as much as $400 million in incentives from the state of South Carolina, Gov. Mark Sanford said in an interview with Bloomberg.

A compelling argument raised by the union must be addressed. Were we to factor in the union’s creditable argument that the labor quality and productivity will suffer, we see the necessity for Dollars and Numbers analysis to justify the Win-Lose strategy selection.

Boeing could offset some of this work force deficiency by moving some willing employees from WA to SC, importing highly skilled labor, and investing in an intensive worker training program. Assume for the purpose of calculation that the SC work force is 10% less productive than the WA state force. This would add 10% of the average $15 hourly cost of $1.50. If Boeing were to also invest another 10% per labor hour $1.50/hr per worker in a worker training program, then a total of $3/hour or about 20% of the $15/hr cost would represent the erosion in savings to Boeing. Continuing the calculation, $3/hr @ 4 Million hours per plane would add a total $12 million per plane raising the unit cost to $72 Million in SC versus the $104 in WA. The total savings for all 840 planes still would approach $30 Billion.

Whatever the actual percentages are (the hypothetical figures used for calculation are believed to be reasonable), it is clear that the 40%+ savings in labor per hour creates billions of dollars in justification for the Issue and the thus the choice of Win-Lose.

Moral of the Story

What are the major take away lessons for the purchasing pro, indeed, any practicing business management pro?

- Win-Lose was the best choice given that the Issue clearly dominated the Relationship

- The Dollars and Number analysis provided the rational and objective basis that justified by the decision